Our 501c3 process is simple and clients like our process. TaxExemptWorld is a 501c3 lookup resource to search view and download information on nonprofit organizations.

Free Donation Receipt Template 501 C 3 Pdf Word Eforms

Free Donation Receipt Template 501 C 3 Pdf Word Eforms

Nonprofit Explorer includes summary data for nonprofit tax returns and full Form 990 documents in both PDF and digital formats.

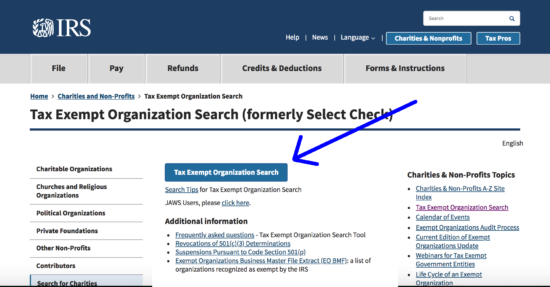

Irs 501c3 lookup. Search a list of organizations that have filed Form 990-N e-Postcard download the database of e-Postcard filings. This massive extraction effort began with 2003 returns and continues today constantly feeding the database used in ERIs Nonprofit. An official website of the United States Government.

Nonprofit Organization. For example searching on the word trust will return all organizations that contain the word trust. Issue Snapshots are employee job aids that provide analysis and resources for a given technical tax issue.

The summary data contains information processed by the IRS during the 2012-2018 calendar years. At the top and bottom of the 501c3 Lookup listings you will see the number of 501c3 records and total pages found. Nonprofit Organization 501C3 Lookup by Zip Code.

Publication 4573 Group Exemptions PDF A publication describing in question and answer format the federal tax rules that apply to group rulings of exemption under Internal Revenue Code section 501. Authoritative data derived from validated sources including 990s and direct reportingverified and updated daily. Tax Exempt and Government Entities Issue Snapshots.

Our service include obtaining the EIN federal tax id number preparing the corporate bylaws and other required IRS documents. Apr 16 2021 827AM. This generally consists of filings for the 2011-2017 fiscal years but may include older records.

Federal annual tax filings for tax-exempt organizations. Easily search 18 million IRS-recognized tax-exempt organizations and thousands of faith-based nonprofits Gather insights on financials peopleleadership mission and more Quality. Updated data posting date.

Exemption Requirements - 501 c 3 Organizations To be tax-exempt under section 501 c 3 of the Internal Revenue Code an organization must be organized and operated exclusively for exempt purposes set forth in section 501 c 3 and none of its earnings may inure to any private shareholder or individual. You can find data retrieved from ERI Economic Research Institutes Library of nearly 7 million Form 990 990PF and 990EZ reports. Information including reported compensation data from these IRS returns is processed at the rate of 60000 returns per month.

Enter a 5-Digit ZIP Code Organization Name or 9-Digit Tax ID EIN Use the Nonprofit Organization lookup to find information pertaining to nonprofits. Use this page to. Enter a five digit zip code.

Learn the tax basics for 501c3 exempt organizations. 06-11-18 Search Tax Exempt Organization Search. You can use the PREV NEXT arrows to navigate through the list of 501c3 records or you can type in a page number to advance further into the results.

Call us at 877-457-2550 or email This email address is being protected from spambots. See details on assets. View information like names addresses assets income and IRS subsections for over 15 million US.